As reported in the LA Times, “Aetna claimed this [past] summer that it was pulling out of all but four of the 15 states where it was providing Obamacare individual insurance because of a business decision — it was simply losing too much money on the Obamacare exchanges.

‘Now a federal judge has ruled that that was a rank falsehood. In fact, says Judge John D. Bates, Aetna made its decision at least partially in response to a federal antitrust lawsuit blocking its proposed $34-billion merger with Humana. Aetna threatened federal officials with the pullout before the lawsuit was filed, and followed through on its threat once it was filed. Bates made the observations in the course of a ruling he issued Monday blocking the merger.

‘Aetna executives had moved heaven and earth to conceal their decision-making process from the court, in part by discussing the matter on the phone rather than in emails, and by shielding what did get put in writing with the cloak of attorney-client privilege, a practice Bates found came close to “malfeasance.”

“Aetna tried to leverage its participation in the exchanges for favorable treatment from DOJ regarding the proposed merger.” — U.S. District Judge John D. Bates

‘The judge’s conclusions about Aetna’s real reasons for pulling out of Obamacare — as opposed to the rationalization the company made in public — are crucial for the debate over the fate of the Affordable Care Act. That’s because the company’s withdrawal has been exploited by Republicans to justify repealing the act. Just last week, House Speaker Paul Ryan (R-Wis.) cited Aetna’s action on the “Charlie Rose” show, saying that it proved how shaky the exchanges were.

‘Bates found that this rationalization was largely untrue. In fact, he noted, Aetna pulled out of some states and counties that were actually profitable to make a point in its lawsuit defense — and then misled the public about its motivations. Bates’ analysis relies in part on a “smoking gun” letter to the Justice Department in which Chief Executive Mark Bertolini explicitly ties Aetna’s participation in Obamacare to the DOJ’s actions on the merger, which we reported in August. But it goes much further.

‘Among the locations where Aetna withdrew were 17 counties in three states where the Department of Justice asserted that the merger would produce unlawfully low levels of competition on the individual exchanges. By pulling out, Aetna could say that it wasn’t competing in those counties’ exchanges anyway, rendering the government’s point moot: “The evidence provides persuasive support for the conclusion that Aetna withdrew from the on-exchange markets in the 17 complaint counties to improve its litigation position,” Bates wrote. “The Court does not credit the minimal efforts of Aetna executives to claim otherwise.”

‘Indeed, he wrote, Aetna’s decision to pull out of the exchange business in Florida was “so far outside of normal business practice” that it perplexed the company’s top executive in Florida, who was not in the decision loop.

“I just can’t make sense out of the Florida dec[ision],” the executive, Christopher Ciano, wrote to Jonathan Mayhew, the head of Aetna’s national exchange business. “Based on the latest run rate data . . . we are making money from the on-exchange business. Was Florida’s performance ever debated?” Mayhew told him to discuss the matter by phone, not email, “to avoid leaving a paper trail,” Bates found. As it happens, Bates found reason to believe that Aetna soon will be selling exchange plans in Florida again.

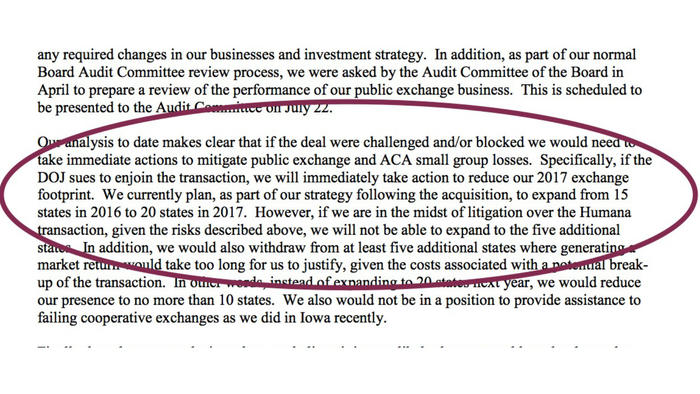

‘As for Aetna’s claimed rationale for withdrawing from all but four states, Bates accepted that the company could credibly call it a “business decision,” since the overall exchange business was losing money; he just didn’t buy that that was its sole reason. He observed that the failings in the marketplace existed before Aetna decided to withdraw, but that as late as July 19, the company was still planning to expand its footprint to as many as 20 states. In April, top executives had told investors that Aetna had a “solid cost structure” in Florida and Georgia, two states it dropped.

‘While the Department of Justice was conducting its investigation of the merger plans but before the DOJ lawsuit was filed, “Aetna tried to leverage its participation in the exchanges for favorable treatment from DOJ regarding the proposed merger,” Bates observed. During a May 11 deposition of Bertolini, an Aetna lawyer said that if the company “was not ‘happy’ with the results of an upcoming meeting regarding the merger, ‘we’re just going to pull out of all the exchanges.’”

‘Not such a veiled threat? Aetna’s Mark Bertolini tells the DOJ what will happen if it blocks the Humana merger. After the DOJ sued to kill the deal, Aetna cut back even more.

‘In private talks with the DOJ, Aetna executives continually linked the two issues, even while they were telling Wall Street that the merger was “a separate conversation” from the exchange business. Bertolini seemed almost to take the DOJ’s hostility to the merger personally: “Our feeling was that we were doing good things for the administration and the administration is suing us,” he said in a deposition.

‘Bates found “persuasive evidence that when Aetna later withdrew from the 17 counties, it did not do so for business reasons, but instead to follow through on the threat that it made earlier.”

‘The threat certainly was effective in terms of its impact on the Affordable Care Act, since Aetna’s withdrawal has become part of the Republican brief against the law. That it says so much more about Aetna executives’ honesty and integrity probably won’t get cited much by GOP functionaries trying to repeal the law. Aetna is at least partially responsible for placing the health coverage of more than 20 million Americans in jeopardy; that it did so at least partially to promote a merger that would bring few benefits, if any, to its customers is an additional black mark.

‘If there’s a saving grace in this episode, it’s that the company’s goal to protect the merger hasn’t worked, so far. The DOJ brought suit, and Bates has now thrown a wrench into the plan. Aetna has said it’s considering an appeal, but the merger is plainly in trouble, as it should be.”

Carolyn Elefant

Carolyn Elefant